The smart Trick of Palau Chamber Of Commerce That Nobody is Discussing

Table of ContentsPalau Chamber Of Commerce Fundamentals ExplainedThe Greatest Guide To Palau Chamber Of CommerceThe 9-Second Trick For Palau Chamber Of CommercePalau Chamber Of Commerce for DummiesThe Palau Chamber Of Commerce StatementsExcitement About Palau Chamber Of CommerceThe Facts About Palau Chamber Of Commerce RevealedSome Known Details About Palau Chamber Of Commerce

As a result, nonprofit crowdfunding is grabbing the eyeballs these days. It can be made use of for specific programs within the company or a basic donation to the cause.During this action, you could wish to think regarding milestones that will certainly show a chance to scale your nonprofit. Once you have actually operated awhile, it is necessary to take some time to think of concrete growth goals. If you haven't already created them during your planning, create a set of vital performance signs as well as milestones for your not-for-profit.

The 2-Minute Rule for Palau Chamber Of Commerce

Without them, it will certainly be difficult to examine as well as track progress later on as you will certainly have nothing to determine your outcomes versus and also you will not understand what 'effective' is to your not-for-profit. Resources on Starting a Nonprofit in different states in the United States: Beginning a Not-for-profit FAQs 1. Just how much does it set you back to start a nonprofit organization? You can begin a not-for-profit company with an investment of $750 at a bare minimum as well as it can go as high as $2000.

Fascination About Palau Chamber Of Commerce

With the 1023-EZ form, the handling time is usually 2-3 weeks. 4. Can you be an LLC and also a nonprofit? LLC can exist as a not-for-profit minimal liability business, nonetheless, it ought to be totally possessed by a single tax-exempt not-for-profit company. Thee LLC must additionally meet the requirements according to the internal revenue service required for Restricted Responsibility Business as Exempt Company Update.

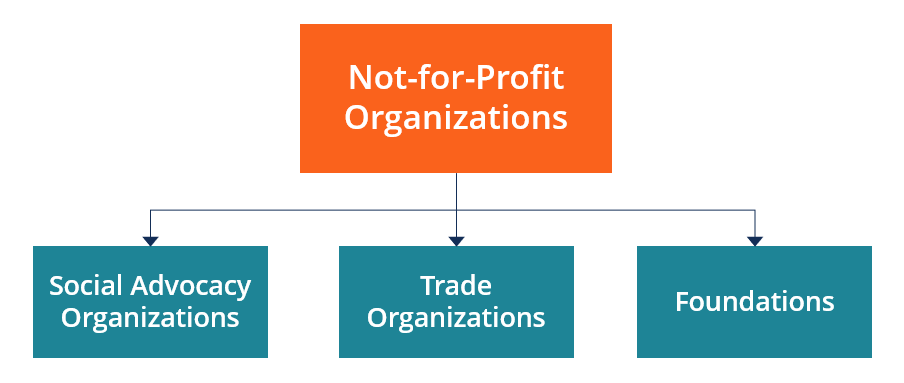

What is the difference between a foundation as well as a nonprofit? Structures are typically moneyed by a family members or a company entity, yet nonprofits are funded through their profits and also fundraising. Structures normally take the cash they began out with, spend why not find out more it, and after look here that disperse the money made from those investments.

See This Report on Palau Chamber Of Commerce

Whereas, the added money a not-for-profit makes are used as running costs to fund the company's objective. Is it tough to start a not-for-profit company?

Although there are numerous actions to start a not-for-profit, the obstacles to entry are reasonably few. 7. Do nonprofits pay tax obligations? Nonprofits are exempt from federal revenue taxes under section 501(C) of the internal revenue service. However, there are specific scenarios where they may require to pay. As an example, if your not-for-profit makes any kind of revenue from unassociated tasks, it will certainly owe income taxes on that particular quantity.

The Main Principles Of Palau Chamber Of Commerce

By much the most usual kind of nonprofits are Section 501(c)( 3) organizations; (Area 501(c)( 3) is the component of the tax code that anonymous authorizes such nonprofits). These are nonprofits whose mission is philanthropic, spiritual, educational, or scientific.

Palau Chamber Of Commerce - Questions

The bottom line is that personal foundations get a lot worse tax obligation therapy than public charities. The major distinction between private foundations and also public charities is where they obtain their economic support. A personal foundation is normally managed by a private, household, or corporation, and also gets most of its income from a few benefactors as well as investments-- a good instance is the Expense as well as Melinda Gates Foundation.

The 3-Minute Rule for Palau Chamber Of Commerce

The majority of foundations simply provide cash to other nonprofits. As a functional matter, you need at least $1 million to begin a private foundation; or else, it's not worth the problem and expense.

Various other nonprofits are not so lucky. The internal revenue service initially presumes that they are personal structures. A brand-new 501(c)( 3) company will certainly be identified as a public charity (not an exclusive structure) when it uses for tax-exempt standing if it can reveal that it sensibly can be anticipated to be openly sustained.

Fascination About Palau Chamber Of Commerce

If the internal revenue service classifies the nonprofit as a public charity, it keeps this standing for its first 5 years, no matter the public assistance it in fact gets during this time. Palau Chamber of Commerce. Starting with the not-for-profit's sixth tax obligation year, it should show that it meets the public support examination, which is based on the assistance it obtains throughout the existing year and also previous four years.

If a nonprofit passes the examination, the IRS will certainly remain to monitor its public charity condition after the initial five years by requiring that a completed Arrange A be submitted every year. Palau Chamber of Commerce. Learn more concerning your not-for-profit's tax obligation standing with Nolo's publication, Every Nonprofit's Tax obligation Overview.